Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto

- Thread starter huskers1217

- Start date

- Joined

- Aug 17, 2020

- Posts

- 17,338

- Reaction score

- 29,417

- Bookie:

- $ 200.00

I’m not even gonna pretend to know what owning the commercial rights to an NFT means.I'll bet @broncosmitty did it.

But I’d like to think my answer to everything Seth Green could ask me, would be

How bout no!

- Joined

- Aug 17, 2020

- Posts

- 15,595

- Reaction score

- 20,369

- Bookie:

- $ 1,000.00

I’m not even gonna pretend to know what owning the commercial rights to an NFT means.

But I’d like to think my answer to everything Seth Green could ask me, would be

How bout no!

- Joined

- Aug 17, 2020

- Posts

- 17,338

- Reaction score

- 29,417

- Bookie:

- $ 200.00

What channel is that on?Yikes. Sounds like this thief saved us all.

This is still not as dumb as Ashton Kutcher's show about cats who smoke weed that cost people like $700 in ETH to watch.

My ol’ buddy George used to love to get high. I’m assuming ETH is like Vcash.

- Joined

- Aug 19, 2020

- Posts

- 860

- Reaction score

- 2,116

- Bookie:

- $ 25,000.00

ETH is like Vcash if you have to pay $100 Vcash to spend $2 Vcash.What channel is that on?

My ol’ buddy George used to love to get high. I’m assuming ETH is like Vcash.

- Joined

- Aug 17, 2020

- Posts

- 29,665

- Reaction score

- 60,792

- Bookie:

- $ 30,703.00

- Location

- SoCal. The Promised Land.

VCash is probably a better asset than that shitcoin.What channel is that on?

My ol’ buddy George used to love to get high. I’m assuming ETH is like Vcash.

- Joined

- Aug 17, 2020

- Posts

- 29,665

- Reaction score

- 60,792

- Bookie:

- $ 30,703.00

- Location

- SoCal. The Promised Land.

- Joined

- Aug 17, 2020

- Posts

- 29,665

- Reaction score

- 60,792

- Bookie:

- $ 30,703.00

- Location

- SoCal. The Promised Land.

- Joined

- Aug 17, 2020

- Posts

- 13,207

- Reaction score

- 16,660

- Bookie:

- $ 1,354.00

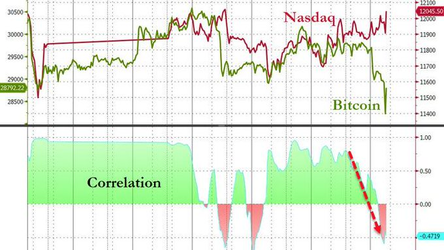

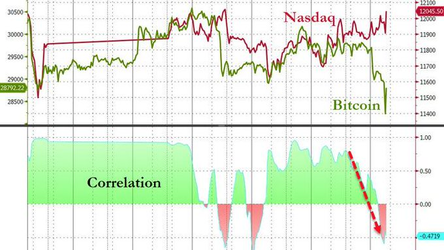

Bubbles.

www.zerohedge.com

www.zerohedge.com

Tchir: Crypto Versus The Fed? | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

- Joined

- Aug 17, 2020

- Posts

- 26,606

- Reaction score

- 29,614

- Bookie:

- $ 5,494.00

- Location

- Sitting in Houston Traffic....

How Influencers Hype Crypto, Without Disclosing Their Financial Ties

Logan Paul had a message for his six million Twitter followers: He was “all in” on a new cryptocurrency called

dnyuz.com

TerraUSD Crash Led to Vanished Savings, Shattered Dreams :

TerraUSD was touted as a blue-chip cryptocurrency. Now its investors are reeling from painful losses and asking if it was all a get-rich-quick scheme.

A surgeon in Massachusetts can’t stop thinking about how he lost his family’s nest egg. A young Ukrainian considered suicide after losing 90% of his savings. Other investors have given up dreams of starting new businesses or quitting their day jobs.

All of them were swept up in the mania for TerraUSD, whose total value swelled to $18 billion before collapsing earlier this month. The coin’s sudden downfall is a reminder that crypto—which enjoyed a huge bull market last year—is often little more than a casino, with weak regulation and few means of recourse for the losers.

The crash caught many investors off guard because TerraUSD was a stablecoin, designed to maintain its value of $1 per coin. Unlike bitcoin, which has crashed repeatedly in its short history, TerraUSD was pitched as a harbor from volatility. It slipped below $1 earlier this month and was trading around 8 cents on Thursday.

TerraUSD was touted as a blue-chip cryptocurrency. Now its investors are reeling from painful losses and asking if it was all a get-rich-quick scheme.

A surgeon in Massachusetts can’t stop thinking about how he lost his family’s nest egg. A young Ukrainian considered suicide after losing 90% of his savings. Other investors have given up dreams of starting new businesses or quitting their day jobs.

All of them were swept up in the mania for TerraUSD, whose total value swelled to $18 billion before collapsing earlier this month. The coin’s sudden downfall is a reminder that crypto—which enjoyed a huge bull market last year—is often little more than a casino, with weak regulation and few means of recourse for the losers.

The crash caught many investors off guard because TerraUSD was a stablecoin, designed to maintain its value of $1 per coin. Unlike bitcoin, which has crashed repeatedly in its short history, TerraUSD was pitched as a harbor from volatility. It slipped below $1 earlier this month and was trading around 8 cents on Thursday.

- Joined

- Aug 17, 2020

- Posts

- 29,665

- Reaction score

- 60,792

- Bookie:

- $ 30,703.00

- Location

- SoCal. The Promised Land.

Do Kwon needs to be in jail. Instead he just launched 2.0TerraUSD Crash Led to Vanished Savings, Shattered Dreams :

TerraUSD was touted as a blue-chip cryptocurrency. Now its investors are reeling from painful losses and asking if it was all a get-rich-quick scheme.

A surgeon in Massachusetts can’t stop thinking about how he lost his family’s nest egg. A young Ukrainian considered suicide after losing 90% of his savings. Other investors have given up dreams of starting new businesses or quitting their day jobs.

All of them were swept up in the mania for TerraUSD, whose total value swelled to $18 billion before collapsing earlier this month. The coin’s sudden downfall is a reminder that crypto—which enjoyed a huge bull market last year—is often little more than a casino, with weak regulation and few means of recourse for the losers.

The crash caught many investors off guard because TerraUSD was a stablecoin, designed to maintain its value of $1 per coin. Unlike bitcoin, which has crashed repeatedly in its short history, TerraUSD was pitched as a harbor from volatility. It slipped below $1 earlier this month and was trading around 8 cents on Thursday.

I hear the Koreans are after him though.

Continued from WSJ:

Keith Baldwin, a 44-year-old surgeon who lives outside New Bedford, Mass., saved $177,000 during the past decade. Last year he took his savings and bought USD Coin, putting it in a crypto account that paid a 9% annual yield.

In April, he moved it into a pseudo-savings account powered by TerraUSD that offered 15%. More than 90% of his savings vanished in a few days when TerraUSD lost its peg to the dollar. Dr. Baldwin said he didn’t know that Stablegains, the startup that managed the account, was converting his USD Coin holdings into TerraUSD. (USD Coin has kept its $1 peg.)

Keith Baldwin, a 44-year-old surgeon who lives outside New Bedford, Mass., saved $177,000 during the past decade. Last year he took his savings and bought USD Coin, putting it in a crypto account that paid a 9% annual yield.

In April, he moved it into a pseudo-savings account powered by TerraUSD that offered 15%. More than 90% of his savings vanished in a few days when TerraUSD lost its peg to the dollar. Dr. Baldwin said he didn’t know that Stablegains, the startup that managed the account, was converting his USD Coin holdings into TerraUSD. (USD Coin has kept its $1 peg.)

Do Kwon needs to be in jail. Instead he just launched 2.0

I hear the Koreans are after him though.

I read that yesterday or day before. Lots of his "followers/investors" are behind the move, thinking they can recoup some of their money.

This is where the fool me once, fool me twice metaphor kicks in.

Sad.

- Joined

- Aug 17, 2020

- Posts

- 26,606

- Reaction score

- 29,614

- Bookie:

- $ 5,494.00

- Location

- Sitting in Houston Traffic....

TerraUSD Crash Led to Vanished Savings, Shattered Dreams :

TerraUSD was touted as a blue-chip cryptocurrency. Now its investors are reeling from painful losses and asking if it was all a get-rich-quick scheme.

A surgeon in Massachusetts can’t stop thinking about how he lost his family’s nest egg. A young Ukrainian considered suicide after losing 90% of his savings. Other investors have given up dreams of starting new businesses or quitting their day jobs.

All of them were swept up in the mania for TerraUSD, whose total value swelled to $18 billion before collapsing earlier this month. The coin’s sudden downfall is a reminder that crypto—which enjoyed a huge bull market last year—is often little more than a casino, with weak regulation and few means of recourse for the losers.

The crash caught many investors off guard because TerraUSD was a stablecoin, designed to maintain its value of $1 per coin. Unlike bitcoin, which has crashed repeatedly in its short history, TerraUSD was pitched as a harbor from volatility. It slipped below $1 earlier this month and was trading around 8 cents on Thursday.

wonder what crashed for this guy

French financier jumps to death from NYC balcony during apartment showing: sources

A man jumped to his death from a luxury Manhattan high-rise Thursday while taking a tour of a unit with a real estate agent, police sources said.

wonder what crashed for this guy

Nothing jumps out at me right now.

People shouldn't be falling for all these scams.Nothing jumps out at me right now.

wonder what crashed for this guy

I think he was the fall guy.

You just knew NYC real estate was going to experience a plummet some day...