Over $1.6 Billion in Crypto Has Been Stolen From Customers Since Start of Year

Analysis from blockchain security firm CertiK shows that a shocking $1.6 billion in crypto has been exploited from decentralized finance (DeFi) so far this year, surpassing the total amount stolen in all of 2020 and 2021 combined.

CertiK found that March 2022 has seen the biggest loss, with $719.2 million stolen - over $200 million more than what was stolen in all of 2020.

This is because on March 23 this year, validator nodes on Sky Mavis's Ronin network and on Axie Infinity's decentralized autonomous organization (DAO) were compromised when an attacker used hacked private keys to forge withdrawals. By obtaining five of the nine validator keys that are responsible for securing the Ronin network, the hacker was able to drain a total of 173,600 ETH and 25.5 million USDC from the Ronin bridge to a rogue Ethereum (ETH) wallet.

The hacker then sent 2,001 ETH to Tornado Cash, which enhances the privacy of transactions by breaking the on-chain link between a source and a destination address, allowing exploiters to mask their addresses while withdrawing illicitly gained funds.

CertiK also recorded 31 major incidents last month, an average of nearly one a day, with the most valuable being the Beanstalk Farms flash loan attack which saw $182 million siphoned from the network.

The second most valuable heist last month was the $80 million lost by Fei Protocol, followed by the $10 million attack against automated market maker (AMM) protocol Saddle Finance.

CertiK noted that April 2022 holds the record for highest dollar amount losses in flash loan attacks ever recorded with overall losses reaching $301.4 million. In comparison, flash loan attacks in January, February, and March 2022 caused a combined $6.7 million loss.

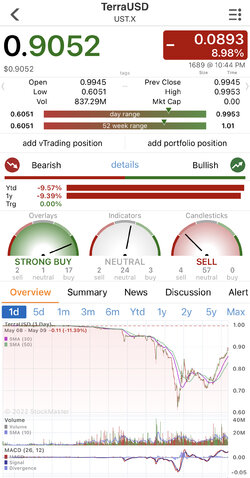

The new analysis comes as DeFi's total value locked (TVL) has dropped below $200 billion for the first time since March 2022, according to data from DefiLlama.

Between April 30, 2022 and May 1, 2022, its TVL dropped by over 3.5% to $195.87 billion and the last 30 days has seen a 13.5% decrease. This represents a 22% decline since the all-time high of over $254 billion in December 2021.

Called it before. It's Kleptocurrency.