- Joined

- Aug 17, 2020

- Posts

- 42,526

- Reaction score

- 51,265

- Bookie:

- $ 10,650.00

Ok, boomer

Your taste in music is just like Dole's taste in women.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Ok, boomer

Your taste in music is just like Dole's taste in women.

So who was your cool one in the backstreet boys? Do you still have his poster by your bed?Ok, boomer

Give me a list of names and let me pickSo who was your cool one in the backstreet boys? Do you still have his poster by your bed?

Hazard insurance will be another $3,000 - $3,500.

Too old school. He's all in on BTS.So who was your cool one in the backstreet boys? Do you still have his poster by your bed?

You may not be that far away soon.mine is 4600 because coastal county......

im 60 miles from the coast.

Ugh. Ours is hail.mine is 4600 because coastal county......

im 60 miles from the coast.

I'm sure you have a favorite Ghetto Avenue boy, right?Give me a list of names and let me pick

how else do you stalk young men and groom them to your favorite college????

are you a fan or not???

speaking of which..

Saturday is Ochuan day. Deciding between Nebraska and UT

mine is 4600 because coastal county......

im 60 miles from the coast.

They match, but I don’t know at what rate. I do spend a decent percentage on ESPP and I’m over the halfway mark to max out for my 401k contributions for the year so I guess I’ll take that W.What in the actual fuck? My take home is almost 65% of my total gross.

Does your employer match retirement at least? 2-1? 3-1?

You got IT!!I'm sure you have a favorite Ghetto Avenue boy, right?

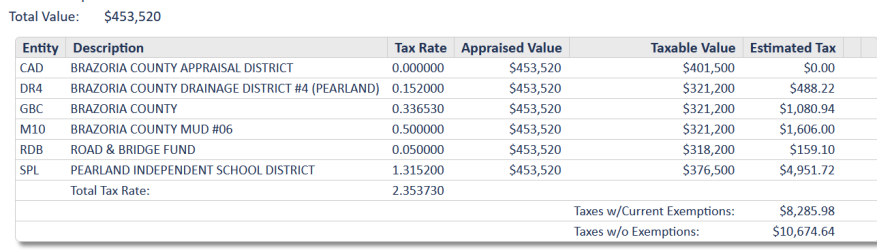

That’s where Texas fucks you. No state income tax, but my property tax will be close to $15K this year.

My assessment was $855K, but my taxes are based upon $744K. That’s because my taxes were based on $677 last year and it can only go up 10% per year. My assessment last year was crazy low, so that helped me this year. Honestly, even $855K is low based on what the market is around here.No worries if you don't want to answer, but I'm curious ...

What's the value of the property according to the Texas Tax People?

Here, my tax bill is assessed based on what I paid for the house when I bought it, and however much is has appreciated over the years, although the "appreciation" seems to be based on some calculation other than how much the house would likely sell for if it was on the market.

They match, but I don’t know at what rate. I do spend a decent percentage on ESPP and I’m over the halfway mark to max out for my 401k contributions for the year so I guess I’ll take that W.

My assessment was $855K, but my taxes are based upon $744K. That’s because my taxes were based on $677 last year and it can only go up 10% per year. My assessment last year was crazy low, so that helped me this year. Honestly, even $855K is low based on what the market is around here.

The only reason I’d like to know my death date is so that I could spend every last penny I have and max out all my credit cards.wood the chick under her desk..

i mean get the match from your employer than look into roth ira's too

tax now is much less than tax when you withdraw it

I’m thinking about it for exactly that reason. Problem is the comps around here are all higher.are you fighting it?

so here is my situation

View attachment 70026

am i fighting the 453k and If i do.... I guess the 10% still maxes so I guess I'm fighting for a lower appraised value so my 10% is less next year

does that make sense?

I’m thinking about it for exactly that reason. Problem is the comps around here are all higher.