50 degrees and sunny. Breaking out the sunscreen.

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

tReal Official Night Shift v67 powered by BitVCash and Spontaneous Dance Parties

- Thread starter Inquisitor

- Start date

- Status

- Not open for further replies.

Tax documents starting to trickle through. IRS starts accepting returns January 29. I should be able to get everything filed by February 15, except I've had a 1099 last year that didn't get to me until the end of February.

- Joined

- Aug 19, 2020

- Posts

- 27,375

- Reaction score

- 33,295

- Bookie:

- $ 5,148.00

Tbf, you need about 309k now to buy 170ks worth of shit in 2014, so it’s a wash.ever look up home values in your old neighborhoods?? fml. i sold a house with this same exact floor plan for 170k back in 2014 now its going for 309k

11830 Leaf Oak Dr, Houston, TX 77065 - HAR.com

Sold: 11830 Leaf Oak Dr, Houston, TX 77065 ∙ $285,001 - $325,000 ∙ 0.13 Acres Lot ∙ 1,697 Sqft, 3 beds, 2 full baths, Single-Family ∙ View more.www.har.com

- Joined

- Aug 19, 2020

- Posts

- 27,375

- Reaction score

- 33,295

- Bookie:

- $ 5,148.00

Getting a 1099 to pay tax on interest from a HYSA is the biggest crock of shitTax documents starting to trickle through. IRS starts accepting returns January 29. I should be able to get everything filed by February 15, except I've had a 1099 last year that didn't get to me until the end of February.

- Joined

- Aug 17, 2020

- Posts

- 26,635

- Reaction score

- 29,649

- Bookie:

- $ 500.00

- Location

- Sitting in Houston Traffic....

Getting a 1099 to pay tax on interest from a HYSA is the biggest crock of shit

all 1099's are a crock of shit

ever look up home values in your old neighborhoods?? fml. i sold a house with this same exact floor plan for 170k back in 2014 now its going for 309k

11830 Leaf Oak Dr, Houston, TX 77065 - HAR.com

Sold: 11830 Leaf Oak Dr, Houston, TX 77065 ∙ $285,001 - $325,000 ∙ 0.13 Acres Lot ∙ 1,697 Sqft, 3 beds, 2 full baths, Single-Family ∙ View more.www.har.com

Damn. Tax rate is a deal breaker. At that tax rate, I'd be paying over $20,000 a year in property taxes. Fuck dat noise.

- Joined

- Aug 17, 2020

- Posts

- 26,635

- Reaction score

- 29,649

- Bookie:

- $ 500.00

- Location

- Sitting in Houston Traffic....

Damn. Tax rate is a deal breaker. At that tax rate, I'd be paying over $20,000 a year in property taxes. Fuck dat noise.

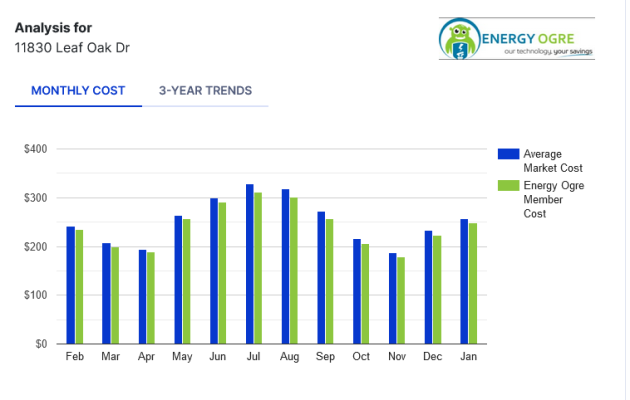

View attachment 115227

its one of the cheapest in texas

- Joined

- Aug 19, 2020

- Posts

- 27,375

- Reaction score

- 33,295

- Bookie:

- $ 5,148.00

I mean, it makes sense for people doing gig work.all 1099's are a crock of shit

Any tax on your own post tax money, is fucking nuts.

Yo dawg, I heard you like taxes, so we’re gonna tax you on the money that you put in your HYSA, that was already taxed once.

its one of the cheapest in texas

Looks pretty solid. I wonder what's wrong with it. Is it an a flood prone area?

Looks like a move to Texas is kaput.

- Joined

- Aug 17, 2020

- Posts

- 18,066

- Reaction score

- 44,794

- Bookie:

- $ 1,885.00

Most retarded fucking highway robbery booshit evar! Honestly- it chaps my fucking ass!Getting a 1099 to pay tax on interest from a HYSA is the biggest crock of shit

- Joined

- Aug 17, 2020

- Posts

- 5,015

- Reaction score

- 10,453

- Bookie:

- $ 4,000.00

Most retarded fucking highway robbery booshit evar! Honestly- it chaps my fucking ass!

What am I missing?

Is this just complaining about paying taxes (which, yes, sucks doneky dicks in hell)?

I mean, investments get taxed.

Even after paying taxes, I still have more $ than I would if I didn't invest the money, so I still come out ahead.

- Joined

- Aug 17, 2020

- Posts

- 18,066

- Reaction score

- 44,794

- Bookie:

- $ 1,885.00

I said what I said. What the fuck do you think chapstick is for?

I said what I said. What the fuck do you think chapstick is for?

Don't get all potty mouth with me, missy.

- Joined

- Aug 17, 2020

- Posts

- 18,066

- Reaction score

- 44,794

- Bookie:

- $ 1,885.00

Yeah, I put what I have leftover after taxes into a HYSA to earn some pennies on the money I’m saving for retirement, then the gov’t taxes those pennies! Total horseshit! They already taxed my money once!What am I missing?

Is this just complaining about paying taxes (which, yes, sucks doneky dicks in hell)?

I mean, investments get taxed.

Even after paying taxes, I still have more $ than I would if I didn't invest the money, so I still come out ahead.

Yeah, I put what I have leftover after taxes into a HYSA to earn some pennies on the money I’m saving for retirement, then the gov’t taxes those pennies! Total horseshit! They already taxed my money once!

Preach, sister, PREACH!!!!

- Joined

- Aug 19, 2020

- Posts

- 27,375

- Reaction score

- 33,295

- Bookie:

- $ 5,148.00

I mean, with HYSA it’s the stupid of the shit.What am I missing?

Is this just complaining about paying taxes (which, yes, sucks doneky dicks in hell)?

I mean, investments get taxed.

Even after paying taxes, I still have more $ than I would if I didn't invest the money, so I still come out ahead.

If you make $40 on $1000, Joe makes sure to get his couple bucks outta that 40. It’s nuts.

- Joined

- Aug 17, 2020

- Posts

- 5,015

- Reaction score

- 10,453

- Bookie:

- $ 4,000.00

Yeah, I put what I have leftover after taxes into a HYSA to earn some pennies on the money I’m saving for retirement, then the gov’t taxes those pennies! Total horseshit! They already taxed my money once!

I fucking hate taxes, but after earning - I think it was around .01% - on my savings for years, I'm so happy to be earning 4.5%, the taxes don't bother me that much. It isn't as though HYSA's get taxed at a higher rate.

Again, though, I get it. Taxes. Suck.

- Status

- Not open for further replies.